Don't Pay UK

Posted on 13th September 2022 at 11:03

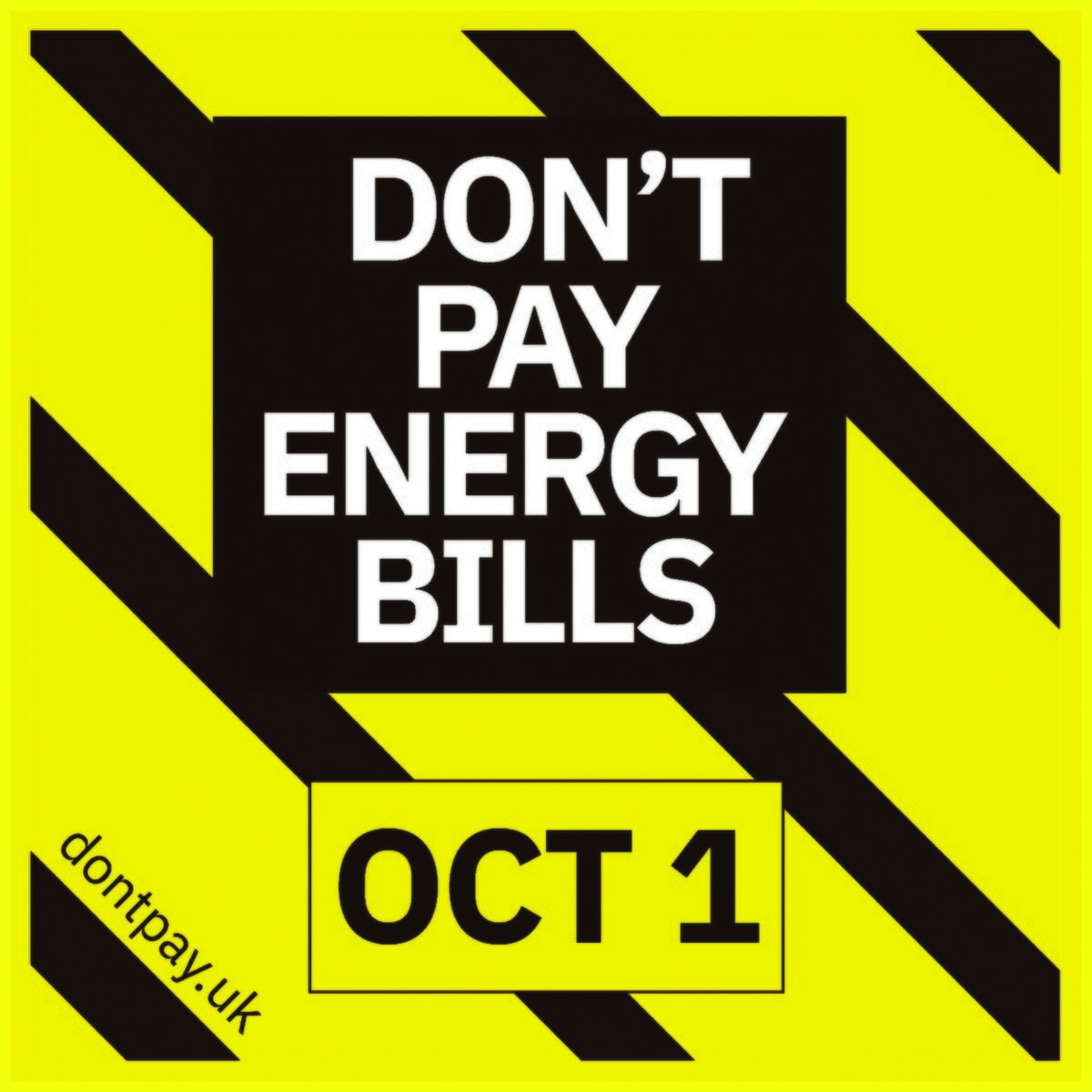

‘Don’t Pay UK’

With Gas & Electric prises on the rise with pressure mounting on the government to take action, a new

pledge is doing the rounds on social media which you will have probably seen ‘Don’t pay UK’. The pledge involves cancelling your utilities direct debits collectively on 1st October, in the hopes that the loss of earnings will spark a reaction within the energy companies to reduce their prices.

Although this seems like a great idea to take matters into your own hands against the energy companies

rather than wait for the government to step in when we otherwise feel powerless, we urge you NOT to take part!

Although you may feel like you are going to turn the tide with this and take a stand against the energy companies, what you are in fact going to do is cause yourself credit issues moving forward when it comes to taking out a mortgage or any other type of credit in the future.

If you cancel your direct debit and stop paying your bills for a month or longer, the energy companies will

in fact place your account into arrears, which if they remain unpaid will be registered as a default. If your

default remains unpaid, they will then pursue court action against you with a county court judgement

(CCJ). If any of these types of adverse credit are showing on your credit report when you come to apply

for a mortgage this can cause some lenders to decline your application as an indication of money

mismanagement. The best case scenario you would need to apply to a specialist lender who accept

adverse credit with a higher interest rate.

Any adverse credit will show on your credit report for 6 years before being removed. So, If you can afford

to pay your bills, then please do. This will mean you will keep a clean credit file for the next 6 years and

you will increase your chances of being approved with your chosen lender. Although it doesn’t seem like

the best option or an option many would like to take but we must wait for the government to act. Taking

part in a reckless act like cancelling your direct debit isnt the answer and can cause you issues for the

next 6 years when applying for credit.

If you are struggling to pay your bills, call your provider to discuss a payment plan or a payment holiday.

DO NOT just cancel your direct debit.

Tagged as: arrears, bills, ccj, debt, energy crisis, energycrisis, highbills, home, homeowner, house, mortgage, rental arrears

Share this post: