2023 review so far...

Posted on 15th June 2023 at 14:26

Well?…

What can we say?

The 1st half of 2023 has been a wild ride in the property and market mortgage! We are going to look at the predictions economists made back in late 2022 and how they played out. We will also look at what has happened already this year and what we can expect to happen for the remainder of this year.

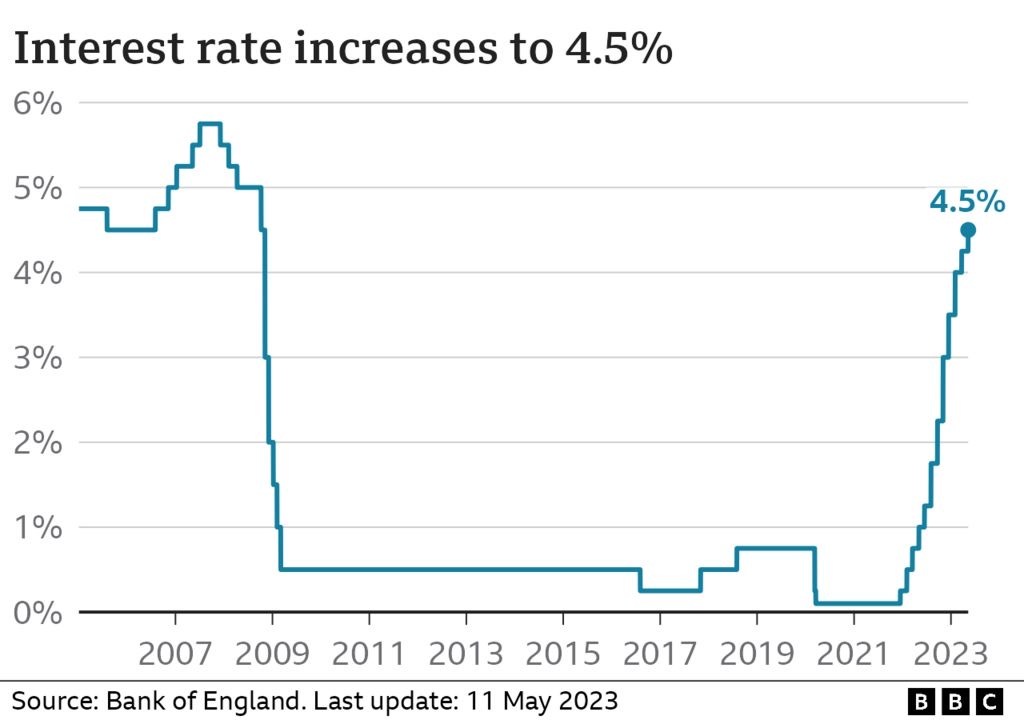

Let’s begin with the ‘hottest’ topic right now in the property market and that is that interest rates have increased 3x since Christmas from a base rate of 3.5% in December to 4.5% in May 2023. The first few rate rises weren’t passed on to customers as lenders pre-empted this happening when Liz Truss and Kwasi Kwarteng dropped their bombshell in the shape of the Autumn budget and interest rates jumped over 1% overnight! Since then, the rate rises had been absorbed by the lenders, but the most recent rate increase has seen that increase in the cost of lending be passed to customer in the form of interest rates for a 5-year fixed rate sitting around 5%+.

House prices

Optimism on property prices back in the Autumn of 2022 for 2023 was at an all-time low, with many predicting that house prices would drop as much as 30% in 12 months! However, after looking at the 1st 6 months of 2023 UK house prices have dropped on average 3.4% from the peak of 2022. A slight drop was always to be expected given the fact 2020-2022 were exceptionally busy as every man and his dog rushed out to buy a new home or renovate the home they already had. As a result of this rally to buy your next home, many of those people who wanted to move house had done so between 2020-2022 the stock on the market at the moment is non-existent in comparison. But if you take a further step back and look at the historical averages for both interest rates and house price change is pretty normal. The historical average interest rate sits around 6% and house price growth of 10%+ year on year just isnt sustainable.

Instead of the crash many had predicted, we are in fact seeing a stabilising of the market as rising interest rates rise back to historical levels and demand for property returning back to pre covid levels. Many people have short memories and just expected prices to continue to grow and rates to drop ‘back to normal’. A bank of England base rate of 0.1% is not normal! 0.1% base rate is the lowest it has been in 300 years, so if you are holding out for interest rates to return to that level before you buy your next home, you will be waiting for a very long time! The average house price currently sits at £286,532.

Even interest rates of 1% were incredibly rare, it took the global credit crisis in 2008 to cause rates to drop that low.

Inflation slowing but not quickly enough.

Inflation is all around us (insert wet wet wet pun here) everywhere we look. Its in the price of everything we buy, as you look at all items they are considerably higher than they were this time last year and the year before. But if we look at 2 main areas in particular and the areas that were the main causes of increasing inflation and we can see that inflation is easing, which is a good sign for interest rates and hosue prices. The Bank of England aim to keep inflation at a steady rate of 2% per year, with inflation at 11% at its highest recently.

The cost of fuel has dropped almost 25% since its peak to now around £1.50 per litre for diesel at the time of writing (this is up north so may differ to other parts of the country). Gas and electric is the 2nd main cause of rising inflation with our gas and electric bills doubling and almost tripling for some overnight. The government had introduced a price cap to curb the rise and the next price cap is due July 2023 which should see the cap reduce from £2,500 to £2,074 meaning our monthly energy costs will reduce from July. These 2 areas off the back of recent rate increases has brought inflation back down to 8.7% btu not close enough to the 2% target.

With the 2 main drivers of inflation being brought under control and the outlook in the are being brighter than initially feared last year we can expect a more positive end to 2023 in terms of interest rates and house prices. Yes, we are expecting a further rate rise because inflation hasn’t dropped enough to hit the 2% annual target but because the trend for inflation is now downwards we can expect the future rate rises to be less significant.

In response to inflation slowing and the previous rate rises having the desired impact we expect the next rate rise to follow the same route as previous rate rises and increase marginally by 0.25% to 4.75%.

Besides rate changes and house prices what else has changed in the property sector? Well, the government released the renter reform bill in summer 2023 which brought in higher standards for landlords and the properties the let out. This relates to the condition of these properties to ensure that any property let is in a safe, healthy and habitable condition. Free from any hazards that could cause ill health or injury and that all amenities are kept in good working condition.

This bill removes ‘no fault evictions’ meaning that landlords must have a reasonable circumstance to evict a tenant and also provide proof of any wrongdoing. The reform bill will also look to introduce periodic tenancies which will roll month to month rather than the standard 6- or 12-month fixed tenancy. Tenants would need to provide 2 months’ notice so that landlords have enough time to find a new tenant ready for the move out date.

The bill aims to provide tenants with more power over how they live and how their tenancy will be treated for example rent review clauses are to be abolished to be replace with a new procedure for increasing rent that involves 2 month’s notice and the right for the tenant to decline. Tenants can also apply to have pets in the home, when previously landlords could market properties as ‘no pets’ only.

The last 6 months has brought us a lot of change as you can see from legislation changes to support tenants to the cost of borrowing and property changing month to month. Looking back at the last 6 months we do seem to be out of the worst of it now with much of the government stimulation taking effect, granted slower than anticipated but it does seem to be working. With that in mind we do expect interest rates to increase again but only by another 0.25% before the end of the year and hosue prices to stabilise as demand is still there for those that can afford to move.

*This blog is our review and prediction of 2023, so time will tell how things play out and if we are correct.

This content will only be shown when viewing the full post. Click on this text to edit it.

Share this post: